New Account Signup

30-days Free

30-days Free

Phone: 405-823-4842

Labor Law Information Resource Center

Rules for Rounding Hours Worked

Time Rounding

-

Among the more frustrating situations for employers to deal with are those times when an employee shows up for work 10 or 15 minutes early, clocks in, then grabs a coffee and cigarette before actually beginning to perform their work. When a company has several employees doing this most every day, such time can be substantial over time. The question then becomes, does the employer have to pay employees for this time on the clock not working? The short answer is yes.

However, employers are not without options for dealing with such behavior. Among the remedies is a practice known as “time rounding,” sometimes referred to as the “7/8ths rule” or “15 minute rule.” The Federal Labor Standards Act (FLSA) allows (but does not require) an employer to round employee time to the nearest quarter hour.

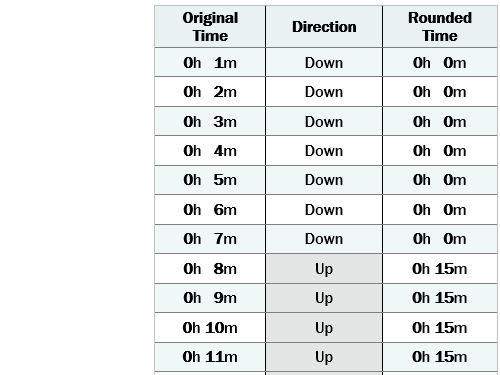

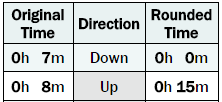

As one example, this 15 minute rounding rule can treat times 7 minutes or less will round down and 8 minutes or higher rounds up. So if an employee clocks in at 7:58 am the time will round up to 8:00. If the employee clocks in at 8:05am the time will round down to 8:00am. The following diagram shows how rounding based on the nearest quarter hour works:

How Shift2Work Can Help

Shift2Work recommends that employers check with an employment/labor law attorney to see if their state has additional regulations (beyond FSLA) regarding rounding. Keep in mind that where there may be a difference between state and federal labor laws, the law that prevails or will apply is the one that favors the employee.

-

✓ Shift2Work’s time clock service provides an advanced system with five different, easy-to-use options for rounding employee work hours.

✓ Rounding using Shift2Work’s service meets all federal guidelines for fair and accurate rounding for employees and employers. Employee time rounds up or down to the nearest time increment set by the system admin.

✓ Since rounding is not required by law, Shift2Work’s time clock service also provides an option to not round work hours.

-

Federal law specifies how employers can round employee time. In general, rounding is allowed only under the following conditions:

1. Rounding must work in both directions, up and down. Employers cannot create a system that works only to their advantage.

2. The greatest amount of time that can be rounded is 15 minutes. If employees clock in more than 15 minutes early, the most time that can be “rounded off” is 15 minutes. For example, an employee clocks in 21 minutes before their scheduled work time. Only 15 of those minutes can be rounded up or off; the remaining 6 minutes is paid as work time.

3. Employees must always be paid for time worked. If an employee clocks in 12 minutes before the start of their shift and is performing their work duties, they must be paid for all of this time even though this work was done prior to the scheduled start of the shift. Rounding does not apply to this scenario,

The following three examples are provided to assist with understanding how this law works under various situations. They are taken verbatim from a web page with the US Department of Labor:

Example #1:

An intermediate care facility docks employees by a full quarter hour (15 minutes) when they start work more than seven minutes after the start of their scheduled shift. Does this practice comply with the FLSA requirements? Yes, as long as the employees’ time is rounded up a full quarter hour when the employee starts working from 8 to 14 minutes before their shift or if the employee works from 8 to 14 minutes beyond the scheduled end of their shift.

Example #2:

An employee’s schedule is 7 a.m. to 3:30 p.m. with a thirty minute unpaid lunch break. The employee receives overtime compensation after 40 hours in a workweek. The employee clocks in 10 minutes early every day and clocks out 7 minutes late each day. The employer follows the standard rounding rules. Is the employee entitled to overtime compensation? Yes.

If the employer rounds back a quarter hour each morning to 6:45 a.m. and rounds back each evening to 3:30 p.m., the employee will show a total of 41.25 hours worked during that workweek. The employee will be entitled to additional overtime compensation for the 1.25 hours over 40.Example #3:

An employer only records and pays for time if employees work in full 15 minute increments. An employee paid $10 per hour is scheduled to work 8 hours a day Monday through Friday, for a total of 40 hours a week. The employee always clocks out 12 minutes after the end of her shift. The employee is paid $400 per week. Does this comply with the FLSA? No.

The employer has violated the overtime requirements. The employee worked an extra hour each week (12 minutes times 5) that was not compensated. The employer has not violated the federal minimum wage requirement because the employee was paid $9.75 per hour ($400 divided by 41 hours), However, the employer owes the employee for one hour of overtime each week.Code of Federal Regulations, Time Clock usage https://www.gpo.gov/fdsys/pkg/CFR-2010-title29-vol3/xml/CFR-2010-title29-vol3-sec785-48.xml